tinyurl.com/c4khe2

As the NAB show starts next weekend in Las Vegas (I’ll be there next Monday and Tuesday), one of the top mindshare topics will be how TV stations can best respond to consumer shifts from linear TV to the on-demand, targeted and interactive world of online and digital TV platforms (including VOD, DVR and mobile).

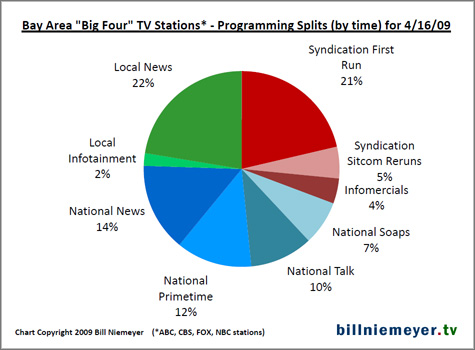

One of the challenges in that shift comes from local TV stations’ current mix of programming. Local TV is mostly not local.

I reviewed the programming schedules of the four major San Francisco broadcast network stations for this coming Thursday, April 16th – a typical broadcast weekday. (Three are O&Os (owned and operated by the networks) – KNTV/NBC, KPIX/CBS, KGO/ABC. The FOX station is KTVU, an affiliate owned by Cox Television, a sibling of MSO Cox Communications.)

Here are the results:

The chart shows, on a time basis for this coming Thursday, the four major Bay Area local TV stations are 24% local. And almost all of that is local news – 22% of air time. Local infotainment (locally produced non-news) is 2%. The rest is programming coming from someone else – 43% from the national network, 26% from syndicators.

Granted, this is looking at programming time, rather than gross ratings points or advertising spend. But, if you’re looking to move your programming to another platform, a key question is how much programming you have to move. Unfortunately for TV stations, much of the local news is repeating the same stories during the day or covering national and world news. (A note – done well, local TV news serves a vital role in the local and regional landscape, especially in times of crisis.) And, if more than three quarters of your shows are coming from someone else, as content producers shift to an on-demand world of multiple platforms you’re at risk of losing exclusivity or access for a lot of your program day.

The traditional home of syndication is broadcast stations. But there has been an increasing shift in syndicated shows appearing on cable networks too. And an increasing amount of what has traditionally been considered broadcast network programming moving to cable, such as original drama series.

In many cases, it’s the major media companies that own the broadcast networks that are competing with their own O&O and affiliate stations. ABC, NBC and FOX are part of corporate families that have robust cable network and syndication portfolios that have been playing their part in shifting viewing from broadcast stations to cable. And, it’s a long term shift that shows no signs of slowing (it’s been over four years since cable passed broadcast in primetime viewing in all US TV households).

DVRs are another continuing and expanding challenge for local stations. "Later that night" time shifting of primetime hurts two key sources of local ad revenue – primetime local avails and the 10PM/11PM news. (Actually called “Same Day” ratings by Nielsen – it’s the time shifting that occurs before 3AM local time. For the November 2008 sweeps Same Day was 47% of all 18-49 time shifting of primetime broadcast based on a Magna Global analysis.) Not only are the local ads in primetime shows being time shifted and therefore sometimes skipped, much of the "later that night" time shifting of primetime shows is probably being done at the expense of late night local news viewing.

Local TV stations do still get a big share of the US TV advertising spend. Magna Global estimates for 2008 put the ad spend on local broadcast spot at $13.1 billion and national into local broadcast spot at $9.8 billion. That’s an overall local broadcast spend of $23 billion, one third of the total US TV ad spend of $70 billion. Add that to cable’s local spot ad revenues of $4.3 billion (NCTA estimated for 2008) and that’s a current $27 billion a year market for locally and regionally directed TV advertising.

How can stations best respond to the shifts in viewing behavior afforded by digital tech?

It starts with TV station’s experienced ad sales organizations, effectively only rivaled in local video by the cable operators’ or third parties that represent local TV inventory. To leverage that sales force, TV stations will need expanded local digital inventory to sell. Part of that comes from offering news content online as TV stations do now. One area for improvement here, many TV station sites are still showing small poor quality video – they need high quality players consistent with what the broadcast networks and Hulu offer. But to avoid a total dependence on news for self-produced content, TV stations should explore an expanded offering of local non-news programming in platforms including online, VOD and mobile (a not inexpensive proposition certainly). They also will need to invest in getting their sales forces up the learning curve on how to sell the new inventory.

Online, stations need to be able to sell local avail inventory in broadcast networks’ full episode players, rather than getting the revenue splits typically seen now (primarily because the technology to avail split has not been implemented).

For VOD as well, stations will need to be able to sell local avails within broadcast network content. Stations also need access to selling advanced TV ad capabilities including addressability and interactivity as those are rolled out. Both require working cooperatively with cable, IPTV and satellite operators (not an easy task given they are direct competitors for ad dollars).

In a difficult economy and depressed local ad market, it’s certainly hard for TV stations to invest the time and effort in pursuing new opportunities. But learning curves are steep, business best practices take time to develop and the in-progress changes caused by digital technology are not going away.