bit.ly/xOuEY

As you may (or may not) have noticed, this newsletter was on “hiatus” this summer as I attended to a variety of other projects. And in retrospect, this summer was not a bad time for a hiatus. It was not a season filled with news (with respect to advanced video and TV). But as we have come to the end of summer, we’ve seen an increase in metrics releases on usage of online video, VOD and TV platforms.

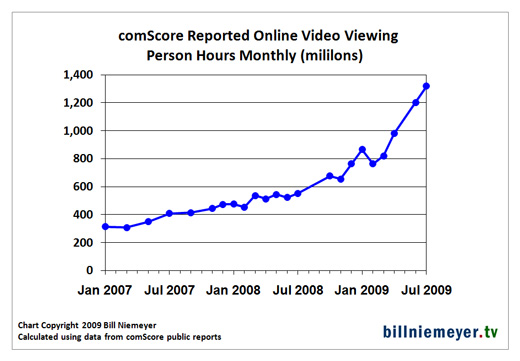

The metrics that most got my attention were in press releases from comScore’s online video measurement service Video Metrix on data for June and July, showing a dramatic ramp up in usage. The comScore data suggests a "hockey stick" style increase in online video use is underway.

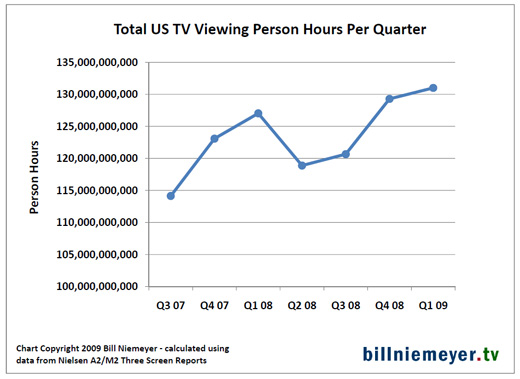

And while I’d like to believe that’s true, Nielsen NetRatings VideoCensus online video data isn’t showing it. An added element of concern… some of the comScore reported increases for June/July for specific media properties are unusually sizeable (as in really really big).

comScore reported June video streams came in at 19.5 billion (up 81% vs. a year ago and 17% vs. April 2009 – comScore didn’t release data for May). July video streams were 21.4 billion, another 10% jump vs. June and 87% vs. a year ago.

Combine this with comScore’s reported 28% increase in average video stream length from July 2008 to July 2009 (2.9 min. to 3.7 min.), and you get a remarkable 139% increase in total time spent watching online video in July vs. a year ago.

Here’s a graph showing total time spent watching video, based on my calculations using comScore Video Metrix press release data going back to January 2007.

So are we seeing a genuine “hockey stick” in online video use?

Maybe… but data from Nielsen’s NetRatings VideoCensus doesn’t show such a dramatic increase. Here’s a comparison of comScore and Nielsen data for July (the comparison is very similar for June).

Continue reading “Is Online Video Use Hockey Sticking? Or Not? comScore vs. Nielsen data…”